Recently, Director of Capital Market Legal Committee of Beijing Huixiang Law FirmZhang Shasha's lawyer teamIn handling the social concern"Remote Vision, Baoxin Financial Leasing and Disputes between Hospitals"Significant results were achieved in the case. In the end, the procuratorate made a decision to obtain a guarantor pending trial for the person in charge of the enterprise involved, and received a notice of withdrawal from the local public security bureau. At the same time, on December 15, 2022, the Supreme People's Court issued the Civil Retrial Ruling Letter, instructing the Shaanxi Provincial Higher People's Court to retrial the disputes between Remote Vision, Baoxin Financial Leasing and hospitals; during the retrial, the original judgment was suspended Execution. Through the unremitting efforts of Zhang Shasha's lawyer team, this case has achieved good legal and social effects.

1. basic case

Established in 2012, Remote Vision was once "the country's largest medical equipment seller". In 2016, Remote Vision's annual income reached 6 billion yuan and its tax payment reached 0.6 billion yuan, making it a "unicorn" in the industry ". With only one eye hospital as the starting point and support, in just a few years, it has opened up the channel resources of thousands of local hospitals across the country and established cooperative relations.

According to reports, the remote vision group has seven Junior College medical projects, including ophthalmology, oncology, cardiovascular and cerebrovascular, gynecology, liver disease, etc., with 4500 employees. Among the county and city level public hospitals above grade 2, more than 2000 hospitals have established cooperative relations with them. In 2016, the operating income of Remote Vision once reached 6 billion yuan and the net profit was 0.6 billion yuan.

In 2017, listed companies Zhongzhu Medical and Galaxy Bio have thrown olive branches to it. In April last year, Zhongzhu Medical suspended trading and proposed to acquire 100 percent of the oncology and cardiovascular business segments of Remote Vision. In the end, the cooperation was aborted due to price issues. Galaxy Bio also planned to acquire 66% of the shares of Remote Vision Cardiovascular Subsidiary at a valuation of 6 billion yuan. Until June 2018, Galaxy Bio was still updating the relevant progress of the acquisition.

In its medical "innovation" model, Remote Vision has signed tripartite agreements with hospitals and financial leasing companies: financial leasing companies contribute funds; Remote Vision is responsible for purchasing medical equipment, advancing equipment rent, helping primary hospitals to operate departments and providing expert guidance; Primary hospitals are responsible for providing venues. The three parties agree to participate in the sharing after the income is generated. Several hospital representatives, former employees of Remote Vision and Remote Vision agents said that about 1000 county-level hospitals have adopted the above-mentioned medical rental model.

However, starting from 2017, the long-range horizon has broken the capital chain and cannot advance the equipment rent. As a result, the financial leasing company sued a large number of tenants (hospitals) to the court.

It has been five years since the Television Medical Lease case. In 2018, a form provided by several hospital representatives showed that a total of 442 hospitals signed three-party equipment procurement contracts with remote vision, but the equipment was not delivered as scheduled, with a total amount of 6.31 billion yuan.

At present, the financial leasing company mentioned in the Civil Ruling issued by the Supreme People's Court is Baoxin Financial Leasing. According to the directors of many hospitals, Baoxin Financial Leasing and Remote Vision have signed medical equipment lease contracts with nearly 100 hospitals, with a total of 128 projects, with a total equipment of more than 1.7 billion yuan and a total rent of about 1.95 billion yuan.

The directors of several hospitals involved in the case told media reporters that they had not received any rental items and did not even see a screw cap. Since July 2019, the chairman of Remote Vision has been criminally detained by a public security bureau in Guangxi and a public security bureau in Tangshan on suspicion of contract fraud. Subsequently, economic investigations in Inner Mongolia, Heilongjiang, Jilin, Liaoning, Shandong, Hebei, Henan, Urumqi, Shanxi, Shaanxi and other places successively set up a special case team to investigate the crime of contract fraud.

2. case handling process

After accepting the entrustment, Zhang Shasha immediately organized the team lawyers to hold a case discussion from the civil and criminal perspectives to accurately find the defense point, that is, the determination of the key issues of the case, such as the contractual legal relationship of the financial leasing company, the hospital and the remote vision, the company's business strategy, the flow of funds and so on. In the first time, he submitted the lawyer's defense opinions and various materials to the local case handling organs, and finally achieved the phased victory of being released on bail pending trial.

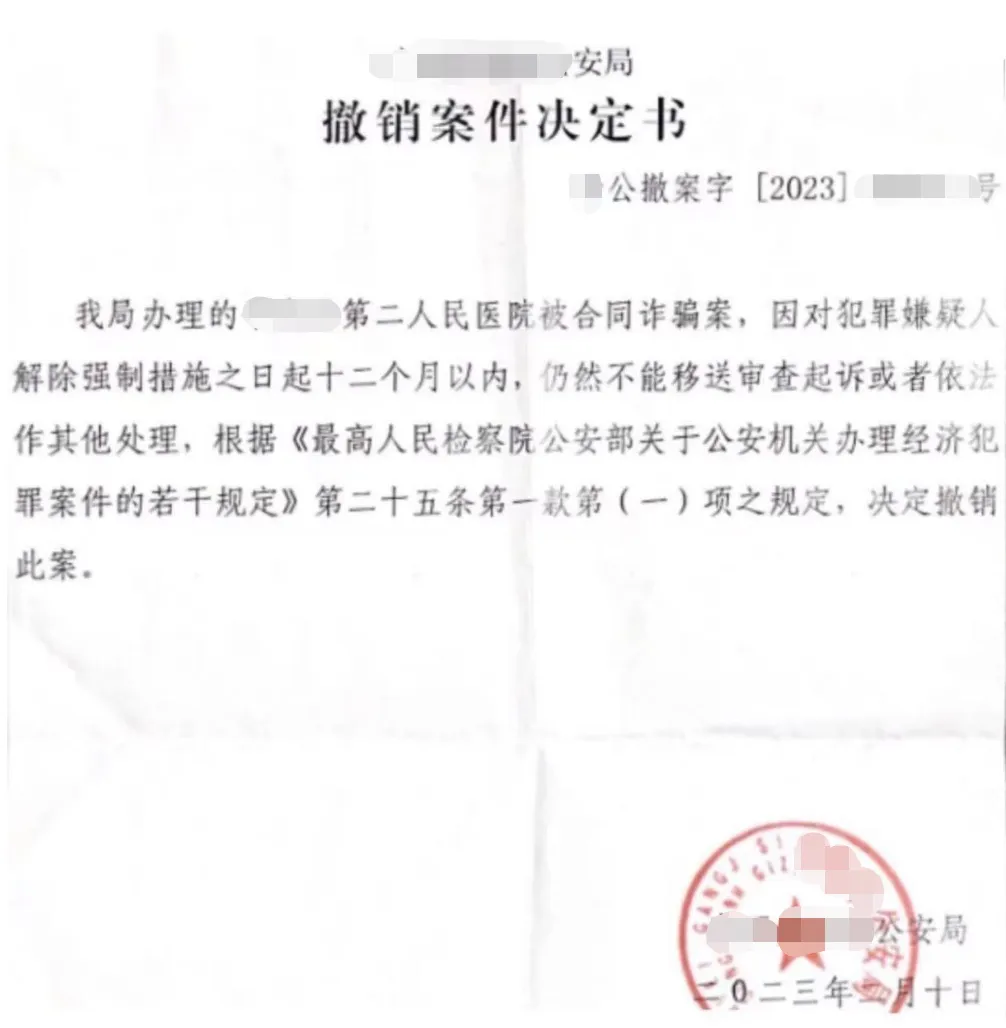

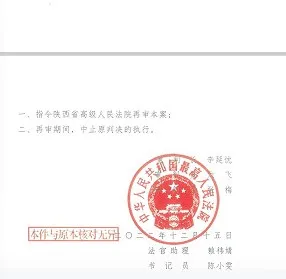

After unremitting efforts, Zhang Shasha's lawyer team finally received the withdrawal decision made by a local public security bureau, and on December 15, 2022, it received the Civil retrial ruling issued by the Supreme people's Court, instructing the Shaanxi Provincial higher people's Court to retrial the disputes between remote vision, Baoxin financial leasing and hospitals; during the retrial, the execution of the original judgment was suspended.

The Civil Ruling Letter of the Supreme People's Court shows whether the leased property involved in the case was actually delivered, whether Baoxin Financial Leasing knew that the hospital had not received the leased property and signed the "Confirmation of Receipt" and "Acceptance Report" in advance, whether Baoxin Financial Leasing had fulfilled the necessary duty of care when paying the purchase money, and whether it knew or should know that the hospital had not received the leased property and still paid to Remote Vision, it is a basic fact that determines the relationship between the rights and obligations of the parties.

3. significance of this case

Lawyer Zhang Shasha talked about the process of handling the case with a lot of emotion. Lawyer Zhang Shasha believes that the reason why the case can achieve phased results is not only due to the efficient work and accurate defense of lawyers, but also due to the introduction and implementation of the criminal justice policy of "less arrest and cautious prosecution. At the same time, another angle to judge the remote vision case, the focus should be to find out the direction of the flow of funds, that is, to find out which party's account the funds of the financial leasing company, the hospital and the remote vision will eventually go to, so as to clarify whether the use of funds is in line with the contract, and the civil and commercial issues will eventually come down to civil and commercial matters. Lawyer Zhang Shasha believes that what is exciting is never the winning judgment, but as a legal professional community, lawyers and the people's court have the same understanding of the legal profession, and they are all earnestly and devoutly using their own practical actions to practice justice and safeguard the rule of law! Similarly, what makes people depressed and angry is never the result of losing a lawsuit.

Whether the Remote Vision case is a commercial risk or a deliberate fraud, no one can jump to conclusions until the court has made a final decision. From the perspective of enterprises, many enterprises have problems similar to remote vision. They are cautious in the early stage, rapid expansion in the later stage, and no reasonable risk control, which eventually leads to the fracture of the capital chain. This is also the problem that enterprises should pay attention to in risk control and legal affairs.

[The pictures in this article are all from the Internet, please contact and delete if there is infringement]

Zhang Shasha

Lawyer Zhang Shasha, a British and Malaysian student, has a master's degree, a postgraduate grade of GPA4.0, and obtained a diploma of excellence. He was a member of the Foreign Affairs Committee of Beijing Haidian Law Association and is currently the director of the Capital Market Law Committee of Beijing Huixiang Law Firm.

Professional fields: foreign-related civil and commercial cases, legal affairs in the capital field, corporate legal affairs, contract law, major and difficult civil and commercial cases, etc.

Related recommend