Huixiang Research

Huixiang Sydney | Australian Minerals Investment Compliance Guide

2023-12-01

On November 5, 2023, Australian Prime Minister Albanese attended the 6th China International Import Expo and met with Chinese leaders on the 6th. Albanese's trip to China is the first visit to China by an Australian Prime Minister since 2016, and it is also an important visit since the leaders of China and Australia met in Bali in November last year. This move will undoubtedly send an important signal to China and the world that Australia is willing to resume friendly trade with China.

In fact, China has been Australia's largest trading partner for more than a decade. As of June this year, the trade volume between the two sides exceeded 303 billion U.S. dollars, accounting for 1/3 of Australia's total trade. The trade between China and Australia includes not only small commodities such as agricultural products and health products, but also bulk commodities such as iron ore, coal and lithium. Especially since this year, after the Chinese government lifted tariffs and trade bans on several products, Australian coal is returning to the Chinese market. In view of this, the purpose of this article is to introduce Australia's key mineral regulations and Australia's newly released "Key Minerals Strategy 2023-2030" to provide compliance guidance for companies willing to invest in minerals in Australia.

Overview of Mineral Resources in 1. Australia

Australia is the largest country in Oceania and the only country in the world that has a whole continent. Such geographical advantages make Australia have a strong natural resource endowment. According to the Australian Bureau of Statistics, there are at least 70 kinds of mineral resources in Australia. Among them, bauxite reserves rank first in the world, accounting for 35% of the world's total reserves, and the proven economic reserves of lead, nickel, uranium, zinc and tantalum rank first in the world. In addition to mining, Australia has a strong manufacturing base. Metal and metal products manufacturing, food, beverages, textiles and other industries are all within the scope of the Australian manufacturing industry. These manufacturing sectors form a close relationship with the mining industry, which promotes each other and supports the diversification of the Australian economy. According to the United States Geological Survey (USGS), Australia will be the world's largest producer of lithium, the fourth largest producer of cobalt and the third largest producer of rare earths in 2022. At present, these key minerals are used in batteries and battery components, rare earth permanent magnets, hydrogen production catalysts, defense technology, and high-performance alloys. [1]

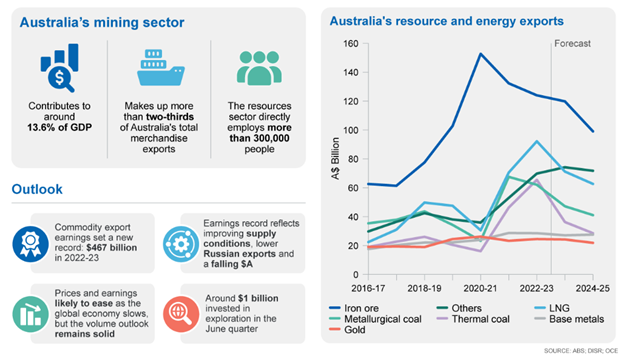

Australia is not only rich in mineral resources, but also has advanced mining equipment, technology and services, and is adjacent to the fast-growing Asian market. Its unique advantages make it the world's leading mining country. According to the World Bank, Australia's GDP will reach $1.68 trillion billion in 2022, up 7.9 percent year-on-year. Since the end of the epidemic, Australia's economic performance has continued to be strong, and mining has played an important role in this. The newly released Resources and Energy Quarterly September 2023 of the Australian Ministry of Industry and Resources shows that in the 2021-2022 fiscal year, Australia's mining output accounted for 13.6 per cent of GDP and more than 2/3 of Australia's total commodity export revenue, with iron ore dominating Australia's mineral energy exports, followed by coal, heavy metals and other mineral resources. [2]

Figure 1: Australian Mining Export Chart

2. Australian Mining Laws

(I) Australian Mining Legislation System

Australia's legal system on mining rights is very mature, not only open and transparent, but also has good management practices. Australia's mineral resources are subject to federal and state decentralized management. The Federation is mainly responsible for offshore oil legislation, environmental legislation and foreign investment and other mining policies to coordinate and develop related legislation, restrict mineral exports, etc., and formulate laws to regulate mining activities in all states, including taxation, indigenous land rights and environmental protection, and occupational health. The states/territories are responsible for mining activities in their respective jurisdictions, including land title, supervision of mine operations, mine safety, environment, health, and collection of royalties and taxes; exploration and mining activities are primarily regulated by the states, but exploration and mining activities in the territories are regulated by the Federation.

In addition, mining legislation regulates exploration and mining activities, creating a system of separation of mining land use rights and land use rights. All mineral deposits within the boundaries of a state are the property of the state in which they are located. Until the deposit is first mined, its ownership remains with the state where it is located. Each state and territory maintains a publicly accessible title register to confirm the registration of land titles and encumbrances. [3]

Australia's laws related to the development and utilization of onshore solid minerals include the Mining Act, the Aboriginal Land Rights Act and the Environmental Protection Act. Among them, the Australian Mining Act provides for three types of authority over mineral resources: ownership, exploration (including preliminary and detailed exploration) and exploitation rights. Each state also has corresponding laws, such as the Mining Act 1992 of New South Wales (Mining Act 1992) and the Mining Act 1978 of Western Australia (Mining Act 1978), which are the basic laws regulating mining development and mining management in each state.

Legal provisions on land issues related to (II) mining

1. Provisions for access to land

Australia's land is divided into state-owned land and private land, of which various types of state-owned land accounted for about 87%, private land accounted for 13%. According to the regulations of the Australian government (Australian Government), any enterprise or individual can purchase government land or private land through auction, but it is not allowed to purchase land with loans. It must be purchased by individual own funds or in partnership. After the land is sold, the government collects land price tax and service fee. At the same time, foreign investors can obtain land contractual management rights in addition to land ownership, but all investments from foreign governments and their related entities (such as state-owned enterprises) in any industry, regardless of the size of the investment, need to go through the Foreign Investment Committee (FIRB) prior approval. [4]

2. Indigenous land rights issues

Aboriginal land rights refer to certain rights held by indigenous Australians based on inherent land and water sources. Aboriginal land rights based on land or water exist only if the right holder claims an inherent link to the land or water, so that Aboriginal land rights are likely to affect investment behavior based on idle land or mining rights. Indigenous land rights include:

-The right to occupy, use or acquire resources on the land;

• Easements;

• The right to visit and protect important areas;

-The right to hunt, fish, obtain food and natural medicine;

-The right to access water, trees, stone and other traditional resources;

-The right to engage in social, religious and culturally related activities and ceremonies.

Although Aboriginal land rights do not include rights to mineral resources, Aboriginal land rights exist on mineral land to be developed, and the Native Title Act 1993 (1993) provides for the registration of Aboriginal land rights and regulates land transactions affecting Aboriginal land rights. Therefore, when carrying out relevant mineral projects, investors need to inquire in the relevant courts about the ownership of aboriginal land rights and investigate whether aboriginal land rights have an impact on the minerals to be invested. If there are Aboriginal land rights on the mineral land to be invested, the investor may negotiate with the Aboriginal people to enter into an Inherent Land Use Agreement to grant the Aboriginal people certain benefits, such as employment or compensation, depending on the specific circumstances, to confirm the ownership of the Aboriginal land use rights.

(III) Australian mining tax levy

Applying for preliminary mineral exploration, mineral reservation and mining license in Australia all need to pay a certain fee. After obtaining the exploration right and mining right, the enterprise also needs to compensate for the damage to the goods on the land to be developed and pay other expenses arising from the termination of the land contract, the restriction of the right of way, the repair of environmental damage, etc. before starting the operation. In New South Wales, Western Australia, South Australia and other places, companies also need to compensate for the loss of land use rights, the reduction of land use rights income and other possible social hazards. The tax collection standards for mineral resource licences in Australia vary from state to state, with the following basic levels:[5]

• Metallic minerals: 1.5-7.5 per cent ad valorum tax rate, or up to 22.5 per cent profit tax rate, with a tax credit policy;

Coal: an ad valorem rate of 2.5-7.5 per cent, or a profit rate of up to 18 per cent, or a fixed rate of 0.04-A $2.34 per tonne;

Non-metallic minerals (sand, limestone, etc.):0.10-1.00 Australian dollars/ton, or 2.75 per cent of output value.

(IV) exploration and mining rights

In Australia, mining activities are governed by the states/territories, each of which has appropriate legal provisions for mining exploration and mining activities within its jurisdiction. This paper takes New South Wales (NSW) as an example to discuss the mineral licensing system.

The basic laws that regulate onshore mining activities (including oil and gas activities) promulgated and implemented by the new state are mainly the Mining Act 1992 and the Petroleum(Onshore)Act 1991 (Petroleum(Onshore)Act 1991). Among them, the Mining Law 1992 mainly regulates and adjusts onshore non-oil and gas minerals, while the Petroleum (Onshore) Law 1991 mainly regulates and adjusts onshore oil and gas minerals. "Mining Law 1992" is the basic law to guide and regulate the mining development and mining management of NSW, which clearly stipulates the basic objectives, basic principles, basic methods and main contents of the mining development and mining management of NSW, including the main management agencies and law enforcement personnel, the form of the main mining rights, the application and acquisition of each mining right, the rights and obligations under each mining right, the relevant restrictions, the duration of each mining right, the circulation and disposal of mining rights, mining rights, mining environmental management, mining land reclamation, the settlement of mining disputes and the penalties for violation of relevant laws and regulations.

It should be noted that since 2008, with the promulgation and implementation of the Mining Amendment Law 2008 (Mining Amendment 2008) and the Mining Regulation 2016 (Mining Regulation 2016), the content of the Mining Law 1992 has been greatly enriched and supplemented to further encourage and promote the exploration and development of mineral resources in NSW, and at the same time improve the requirements for ecologically sustainable development. The Mining Amendment Act 2008 focuses on ecological restoration and compensation to landowners, while the Mining Regulations 2016 for the first time requires owners of exploration licences, appraisal leases and mining leases to submit annual reports to the NSW Remote Areas Department (Department of Regional NSW).

1. EXPLORATION LICENSE (Exploration Licence)

According to the New State's Mining Act 1992, anyone can apply for an exploration license, but in order to avoid disputes, owners of privately owned minerals can apply for an exploration (mineral owner) license (Exploration (mineral owner) Licence) to carry out mineral exploration activities. An application for an exploration license must be submitted to the Secretary with the application fee required by law, except for the opal mining area and the area where the issuance of an exploration license is prohibited under the 1992 of the Mining Law S367, and the application for an exploration license in other areas will be reviewed by the relevant decision maker and will be approved or rejected. The relevant decision makers must consider whether the application involves environmental protection, while others mainly examine whether the applicant's assets and technology meet the minimum standards for exploration.

Upon obtaining an exploration licence, the applicant may:

• To carry out land mineral exploration work within the scope of the licence;

-Prior to the expiration of the licence, if the exploration licence holder applies for an appraisal lease and a mining lease, but the application for both leases is not responded to, the exploration licence continues to be valid until the application is responded.

The application fee for an exploration license is 1000 Australian dollars. After authorization, its validity period is 2-6 years. During the validity period, the exploration license holder can transfer the license or apply for the license extension.

2. Valuation Lease (Assessment Lease)

According to the New State Mining Law 1992, a valuation lease allows the lease holder to retain rights to the land listed on the lease, including the right to explore and recover minerals, if the lease holder evaluates the land to be mined and finds that the land has no commercial value in the short term, but has a good prospect. The applicant for the assessment lease, the manner of submission, the review requirements, and the application restrictions are consistent with the exploration license.

The application fee for an assessment lease is A $2000 and is valid for 2-6 years after authorization. During the validity period, the assessment lease holder can transfer and apply for an extension of the assessment lease.

3. Mining Lease

A mining lease is the exclusive right of the lease holder to mine minerals in a specific area of land. The applicant for the mining lease, the manner of submission and the application restrictions are consistent with the exploration license and assessment lease. However, under the provisions of the New State Mining Law 1992, the applicant can only obtain a mining lease after proving the following:

-The existence of economically mineable deposits in the lease application;

-Miners have the technical and economic strength to extract and do so in a manner that does not harm the environment.

In addition, the Mining Law 1992 provides that mining leases may not be granted for the following land:

• Land specified in the exploration licence;

• Land listed in an already existing assessment lease, mining lease or mineral claim.

After the applicant is granted a mining lease, it has the following rights:

• Exploration and exploitation of designated minerals on the land covered by the lease in accordance with the terms of the lease;

-Primary treatment, such as crushing, granulation, grading, washing and leaching, to separate minerals on the land included in the lease;

• Carry out any other mining activities, etc.

The application fee for a mining lease is A $10000 and, once authorized, is valid for a maximum of 21 years, unless the Premier agrees to an extension.

In the new state, in addition to the above three main mineral exploration and mining rights, there are two special mineral exploration rights: mineral claim (Mineral Claim) and opal exploration license (Opal Prospecting Licence). The former mainly grants the right holder to take preparatory work related to exploration and mining, such as erecting buildings and facilities, clearing trees, stones, etc. The latter primarily grants the licence holder the right to explore opal mines.

4. Mining development management

(1) Development assessment of new mineral projects [6]

In 2007, the new state government issued the State Environmental Planning Policy (Mining, Petroleum Production and Extractive Industries) 2007 (State Environmental Planning Policy (Mining, Petroleum Production and Extractive Industries) 2007), which sets out the basic policies and guidelines of the new state government on mining development and mining management. Its main points include:

-Effective management and overall development of the mineral, oil extraction and quarrying industries for social and economic well-being;

-Promote the orderly development and use of land containing mineral, oil and quarrying raw materials;

-Establish appropriate planning control mechanisms to encourage ecologically sustainable development through environmental assessment and sustainable management of mineral, oil and quarrying raw material development.

At the same time, the policy also clearly defines the issues that need to be considered when accepting and approving applications for mining projects, including the compatibility of planned mines, oil production or quarrying with other land uses, the compatibility of planned development projects with mining, oil production or quarrying, the combination of natural resource management and environmental management, resource recovery, transportation, reclamation and other factors.

(2) Mining management policy

In NSW, the Department of Environment and Planning (NSW Department of Planning and Environment) is one of the key agencies to approve mining and oil projects, while the Department of Department of Regional NSW (NSW) is responsible for the restoration, safety and resource use of mineral projects.

At the same time, the Environmental Protection Action Act 1997 (Protection of the Environment Operations Act 1997) stipulates that exploration and mining activities must meet the requirements of environmental development. In the process of applying for relevant mineral rights, applicants are required to issue an environmental impact report, including: The impact of mining activities on air quality, transportation, animals and plants, surface water, etc., as well as mining methods, landscape management and land restoration.

Environmental Management [7]

The Department of Regional NSW Resources Regulator is responsible for monitoring the compliance of mineral operations with environmental management standards and with the environmental management provisions of the Mining Act 1992 and the Mining Regulations 2016. Includes:

• Review the environmental impact assessment of the proposed exploration and mining activities;

-Promote compliance with exploration and mining activities through on-site inspections, audits (including mandatory and voluntary audits) and periodic review reports;

• Supervision of mine environmental restoration and supervision of mine closure;

• Investigating complaints and incidents;

• Taking appropriate enforcement action for violations, etc.

(4) Environmental restoration

In addition, the NSW Regional Resources Regulatory Department is also responsible for supervising mineral miners to carry out mine environmental remediation, that is, the remediation of pollution in mining wastelands. In accordance with the provisions of the Mining Law 1992, the Regional Regulatory Department ensures that environmental remediation is implemented through the following regulatory methods:

• stipulating environmental management requirements and remediation conditions in mining leases;

• Collection of environmental remediation deposits from exploration licences and mineral lease holders;

-Clarify the enforcement powers of the relevant authorities to ensure that the lease holder fulfils its obligations.

The mineral lease holder must demonstrate that the rehabilitation of the land and waters affected by mining is safe and feasible and must support the land end use approved by the development consent and the rehabilitation plan specified in the Mining Regulations 2016.

3. Australia's Critical Minerals Strategy 2023-2030

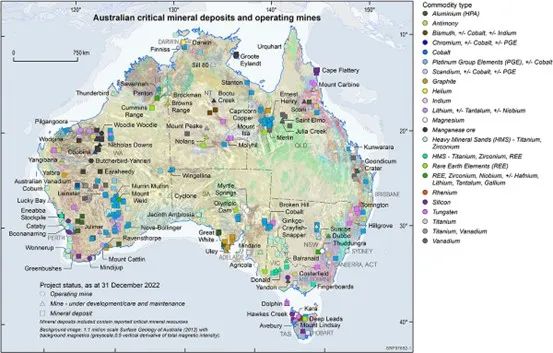

On June 20, 2023, in order to strengthen the layout of Australia's key mineral industry chain and support the development of the key mineral industry, the Australian government issued the "2023-2030 key mineral strategy" (hereinafter referred to as "key mineral strategy"), The six key areas of development include project development, attracting international investment, the interests of Aboriginal communities, environmental and social governance, improving infrastructure investment, and labor force training. At the same time, 26 kinds of minerals are listed as key minerals, including aluminum, lithium, rare earth, graphite, magnesium, manganese, silicon and titanium. The specific distribution is shown in the following figure (data as of December 31, 2022):

Figure 2: Map of key mineral resource mining areas in Australia [8]

The Australian Government's Critical Minerals Strategy sets out four main objectives:(1) to create a diverse, resilient and sustainable supply chain through strong and secure international partnerships;(2) to enhance critical minerals processing capacity;(3) to grow Australia into a renewable energy superpower by relying on critical minerals; and (4) to extract more value from onshore resources, build industries such as mineral extraction and processing and clean energy technology manufacturing, thereby creating jobs and economic opportunities.

In order to achieve the aforementioned objectives, the Key Minerals Strategy further proposes six specific directions to promote the development of key mineral-related industries, including:

Targeted support for strategic project development: The Critical Minerals Strategy further highlights the need to develop downstream industries for critical minerals in Australia. In support of strategic project development, the Critical Minerals Strategy commits to provide $0.5 billion in new investment in critical mineral extraction and processing projects through the Northern Australia Infrastructure Fund (Northern Australia Infrastructure Facility). In addition, the Australian government will set up the National Reconstruction Fund (National Reconstruction Fund), and of this amount, $1 billion will be used to support resource value-added projects related to key minerals and $3 billion to support renewable energy technologies and low-emission technologies. The Government will also continue to assess the appropriateness of relevant policies and programs to use national resources to promote the development of key mineral industries. In addition, the Key Minerals Strategy also proposes to establish a mechanism to continuously update the Key Minerals List to support key mining projects related to priority technologies, such as batteries and battery components, semiconductor technology, and defense technology.

2. Attracting investment and establishing international partnerships to improve the trade and investment environment for preferred technologies: In attracting investment and establishing international partnerships, the Australian Government has launched the Critical Minerals International Partnership (Critical Minerals International Partnerships) project and invested A $57 million. The project will support joint investments between Australia and like-minded international partners.

3. Aboriginal participation and benefit sharing, promoting Aboriginal and community participation and partnership, and expanding Aboriginal rights and investment opportunities: In terms of investment in key mineral sectors, the Australian Government attaches importance to Aboriginal participation and rights in key mineral sectors and encourages energy companies to develop best-practice engagement with Aboriginal communities.

4. Consolidating Australia's position as a world leader in environmental, social and governance (ESG) standards: The Australian Government plans to ensure that environmental protection standards are met while making it possible for strategically important key mineral projects to obtain environmental approval efficiently, while also using renewable fuels to reduce energy demand, promote a circular economy in the key mineral sector and reduce the environmental impact of the key mineral industry, projects such as the Powering Australia Plan will be implemented to achieve the goal of zero carbon emissions by 2050.

5. Open critical infrastructure and services investment: Because critical minerals are widely distributed in Australia, investment in infrastructure and services can help remove geographical constraints and better develop economies of scale in critical minerals. In terms of opening up key infrastructure and service investment, the Australian government will work with relevant industries, communities and regional governments to establish a number of infrastructure projects related to key minerals, through which the development of key mineral industries will be guaranteed and promoted.

6. Develop a skilled workforce: The Australian Government will focus on addressing barriers to workplace safety, cultural differences and work flexibility to attract more women, Aboriginal and multicultural groups to the mining industry and mining-related manufacturing industry, and to raise public awareness of the importance of the mining industry in the country's energy transition. [9]

In general, on the one hand, Australia itself has rich reserves of key minerals and leading mining technologies. Further development of key mineral industries and their downstream refining and processing industries can help increase Australia's key mineral wealth and create economic growth and employment opportunities; On the other hand, the development of related industries can meet supply chain challenges, expand the production of key minerals, promote the stability and diversification of the supply chain, and support the development of the global clean energy industry.

4. mining cooperation between China and Australia

In April 2023, the "China Investment in Australia Research Report" released by the University of Sydney and KPMG, one of the Big Four accounting firms, showed that Chinese investment in Australia in 2022 was 2.1 billion Australian dollars, an increase of 170.2 compared to 0.8 billion Australian dollars in 2021.%. In terms of investment, mining investment accounted for 86% of China's investment in Australia in 2022, and the total investment in iron ore, lithium ore and gold ore projects reached 1.8 billion Australian dollars. Western Australia also attracted the most Chinese investment due to its developed mining industry, reaching 1.6 billion Australian dollars. In Australia's iron ore export map, China accounted for 71% of the total exports. This close trade relationship is of great significance to the economies of both countries.

At present, the mining layout of Chinese enterprises in Australia is very diversified, including large state-owned enterprises and private enterprises, including iron ore, coal and other commodities, as well as key minerals such as lithium and nickel.

For example, BHP Billiton, a well-known Australian mining company, and China Baowu Group signed a memorandum of understanding on cooperation in November 2020. The former plans to invest US $35 million in five years to support China Baowu in developing low-carbon steel production technologies, carrying out pilot projects and industrial-scale experiments, and sharing knowledge with all sectors of the industry, including smart carbon (SCU), carbon-free ironmaking and carbon capture, utilization and storage (CCUS) technologies. At the same time, Baowu and BHP Billiton completed the first cross-border trade settlement of iron ore using a blockchain platform, worth about $14 million.

In addition, Baowu Group and Rio Tinto, one of the world's largest suppliers of resource extraction and mineral products, have set up a joint venture for the Xipo (Western Range) iron ore project in the Pilbara region of Western Australia. The two sides hold 54% and 46% of the shares respectively, and will invest 2 billion US dollars (Rio Tinto invested 1.3 billion US dollars) to develop the mine. The goal of the Xipo project is to produce 0.275 billion tons of iron ore within the joint venture period, with a design capacity of 25 million tons per year, an average grade of about 62%, and a total investment of about US $2 billion. The project is under construction and the company is expected to be completed and put into operation in 2025.

In the key mineral sector, Tianqi Lithium, the country's largest supplier of lithium-ion new energy core materials, holds a 51% stake in Wenfield, the parent company of the world's largest lithium producer, TLEA, through its Australian subsidiary, I .e. it owns about 26% of the Greenbushes spodumene mine. In addition, Tianqi Lithium has four lithium product production bases at home and abroad, and the Western Australia Quina Phase I project is one of them. As the world's first fully automated battery-grade lithium hydroxide plant in operation, the project is an important symbol of Tianqi Lithium's overseas processing business layout.

On the basis of the existing Sino-Australian mining cooperation, it can be imagined that with the Australian Prime Minister's visit to China, Sino-Australian mining cooperation will usher in another "spring". However, under the trend of vigorous cooperation, there is also a certain crisis, the most significant of which is the FIRB (Foreign Investment Committee, for details, please refer to the "Investment Guide to Australia III" previously issued by Huixiang Sydney Law Firm) for Chinese background Investors tend to be strictly regulated.

In February 2023, FIRB rejected a deal by a Chinese fund (the largest shareholder) to increase its stake in the Australian Stock Exchange listed mining company (Australia's largest heavy rare earth mining company, whose main assets are rare earth minerals located in Western Australia and rare earth minerals in the Northern Territory) from 9.92 per cent to 19.9 per cent. Even if the proposed transaction did not reach the proportion of significant interest (20%) stipulated under FATA after the completion of the proposed transaction, FIRB still rejected the transaction on the grounds of protecting Australia's national interest. In addition, on July 20, 2023, FIRB had just rejected an application by a (believed) China-linked US company (with the same director as another Chinese company) to acquire an Australian mining company through a company-arranged deed, with its main assets being a lithium mine in production at Bald Hill, Western Australia. Compared with Chinese investors, investors from the "Five Eyes Alliance" countries (including New Zealand, the United States, Canada and the United Kingdom) and other strategic partners may be more likely to obtain the "green light" of FIRB approval from the 2023 Critical Minerals Strategy and the current trend of international cooperation in Australia ". For example, the Australia-United Kingdom Free Trade Agreement came into force on 31 May 2023, so private investors in the UK will now benefit from a higher threshold under the foreign investment framework for certain amounts of their investments in Australia. For example, for investments in the acquisition of developed commercial land and non-sensitive enterprises, the threshold for triggering FIRB approval has been increased from $0.31 billion to $1.339 billion. To sum up, when Chinese investors invest in mineral resources in Australia, they should pay special attention to the risks related to regulatory approval and take measures in advance.

References:

[1] https://www.usgs.gov/

[2] Resources and Energy Quarterly September 2023, P5.

[3] https://www.legislation.gov.au/Details/F2020C00185 of Mineral Resources Exploration and Evaluation Method (2015)

[4] https://foreigninvestment.gov.au/getting-started/investment-information/land.

[5] https://www.ato.gov.au/businesses-and-organisations/gst-excise-and-indirect-taxes

[6] Mining leases and regulation | Mining, Exploration and Geoscience (nsw.gov.au)

[7] Ibid.

[8] Critical Minerals Strategy 2023-2030, P13.

[9] Ibid., note: P18-P19.

Related recommend

Lawyer Research Center, China University of Political Science and Law

Beijing Lawyers Association