Huixiang Research

Huixiang Sydney | Investment Guide to Australia-Australian Tax Policy (serial 7)

2023-10-11

In the last issue of the investment guide to Australia, the Australian labor law was introduced in detail from the development history of Australian labor laws, Australia's "Fair Work Act", national employment standards, labor contracts, Australian minimum wage standards, working hours, etc. Australian investors need to focus on these aspects when entering into labor contracts with Australian employees.

In addition, investors who go to Australia to invest in Australia, whether they set up enterprises or carry out personal investment and other activities, must pay taxes. Therefore, this issue of the Investment Guide to Australia will provide a detailed explanation of Australia's tax policy.

1. form of business organization

Before introducing Australia's tax policy, we should first make a brief understanding of the form of business organization in Australia. In short, the main forms of business organization in Australia include self-employed (Sole trader), partnership (Partnership), trust (Trust) and company (Company).

(I) self-employed

Australia's self-employed is similar to the domestic self-employed, only need to apply for Australia's ABN (tax registration number) in the name of the individual, you can operate independently. The establishment of individual operators is simple and low-cost, and there is no mandatory financial reporting, only the simple use of excel to record accounts. At the same time, the cost of filing tax returns for self-employed operators is low, and income business only needs to be declared in the business portion of the annual personal tax return without a separate declaration, but if the annual net profit is higher than A $45,000, the excess profit tax rate will be higher than the corporate income tax rate.

In addition, all the business income of the self-employed belongs to the individual, and the assets owned will also enjoy the corresponding tax benefits. However, since the self-employed has 100% control at the operational, control and management levels, the personal financial position and the taxation of the operation are the same entity. Therefore, in the event of insolvency of the business, the individual's assets are also at risk.

(II) Partnership

A partnership is formed by agreement between the parties, and the rights and obligations of the partners are usually set out in a written partnership agreement and governed by the Partnership Act (Partnership Acts) of each state and territory. The partnership does not need to be registered unless the terms of the partnership agreement specifically agree that each partner has the right to participate in the management of the partnership.

In a general partnership, the partnership is not a legal entity independent of the partners, and the partners are subject to unlimited liability for the debts of the partnership. Except for specific professional partnerships (e. g., law firms and accounting firms), the number of partners must not exceed 20. The partnership is also not required to pay income tax on its business income, but each partner is required to report their income in the partnership in their own tax return and pay the corresponding tax.

(III) Trust

Trusts are a more common form of investment in Australia. In a trust, the trustee has legal title to the property (land, equity, etc.) and must manage the property and business of the trust for the benefit of the beneficiaries (who hold the actual beneficiaries). The responsibilities of the trustee to the beneficiaries are governed by the trust deed, state and local legislation and general law.

Trusts can generally be divided into discretionary trusts (Discretionary trusts) and unit trusts (Unit trusts). A discretionary trust is a trust in which the benefits are distributed by the trustee. Under such an arrangement, the trustee has the right to determine which beneficiary will receive how much of the trust property in accordance with the terms of the agreement. Such trusts are particularly common in family businesses or businesses and are generally used to protect family property and for tax planning.

A unit trust is a trust in which an investor subscribes to a unit issued by a trustee, and each unit holder receives a proportional return on the overall assets. Generally speaking, the trustee is a company, the unit trust is not subject to tax, and all proceeds are distributed directly to the unit trust holder, which is paid by the unit trustee according to his or her personal circumstances. Unit trusts are the most used for large and medium-sized investments.

(IV) Company

The registration, operation and governance of Australian companies are subject to the relevant provisions of the Corporate Companies Act (Act 2001(cth)) and are governed by the Australian Securities and Investments Commission ("ASIC"). In general, there are no minimum capital requirements or specific business scope restrictions for setting up a company in Australia. However, there are specific licensing requirements for specific industries, such as banking.

Under the Australian Federal Companies Act, a company can be divided into a company limited by shares (Limited by shares), a company limited by guarantee (Limited by guarantee), an unlimited liability company (Unlimited with share capital) and a company without liability (No liability company). Among them, the limited company is the most common form of business organization in Australia.

(1) Company limited by shares

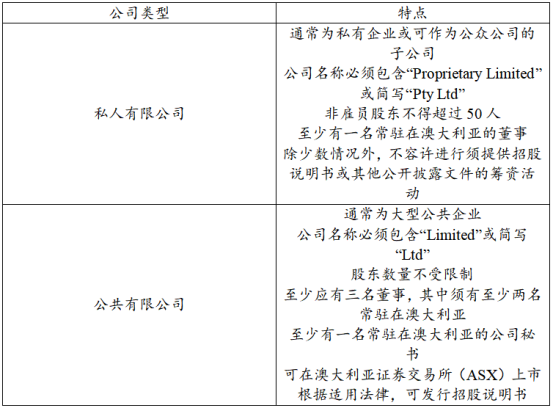

A company limited by shares means that each shareholder is liable externally only to the extent of his or her contribution to the company. Limited companies can be divided into private limited companies (Proprietary Company) and public limited companies (Public Company).

(2) Company Limited by Guarantee

A company limited by guarantee may only be a public company and shall not issue shares to the public. The company name must contain "Limited" or the abbreviation "Ltd". In the event of liquidation of the company, the shareholders shall be liable for the debts of the company to the extent of the amount agreed to contribute in the event of liquidation of the company.

In Australia, non-profit organizations or charities often use the company model of a company limited by guarantee.

(3) Unlimited liability company

An unlimited liability company can be a private company or a public company. Shareholders bear unlimited joint and several liability for the debts of the company. This corporate structure is mainly used for professional associations and is not a common form of business organization.

(4) No liability company

A non-liability company can only be a public company. This is a company model created specifically for the Australian mining industry. It is used to encourage investors to invest in risky mining companies because holders of unpaid shares in the company can withdraw their shares without any legal consequences. This corporate structure is also not a common form of business organization.

In addition, for foreign companies that intend to conduct business in Australia, under the provisions of the Australian Companies Act, they can choose to establish a subsidiary (subsidiary) in Australia, or they can choose to establish a branch (branch) of the foreign company.

If a subsidiary is established, the subsidiary is a legal entity independent of its parent company and has limited liability. Unless special circumstances exist, the parent company is not usually responsible for the debts or obligations of the subsidiary. The establishment of a subsidiary in Australia (privately held company Pty Ltd) by a Chinese company is a common form of company.

The Australian branch of the Chinese company is not an independent legal entity and its operations are not distinguished from the activities of the Chinese parent company in terms of authority and responsibility, so the Chinese company is subject to unlimited joint and several liability for all debts and obligations of the Australian branch. Major Chinese banks usually set up branches (I. e. representative offices) in Australia, and other Chinese companies generally set up subsidiaries in Australia instead of representative offices.

Major Taxes and Related Policies in Australia, 2.

The main components of the Australian tax legal system include court-related jurisprudence, statutory law and international tax treaties, as well as public rulings, category rulings, case-by-case rulings with specific legal effects, as well as non-legally binding legal enforcement notes, public publications, etc. Australia's main taxes include corporate income tax, personal income tax, goods and services tax, stamp duty, consumption tax and so on. Australian taxation is dominated by direct taxes, I .e., corporate income tax and personal income tax. The following mainly introduces corporate income tax, personal income tax, goods and services tax, consumption tax, etc.

(I) Corporate Income Tax (Corporate Income Tax)

Australia divides enterprises into resident enterprises and non-resident enterprises according to the nature of enterprises. Australian resident businesses are subject to income tax on their taxable income worldwide. An Australian non-resident enterprise is only subject to income tax on its income derived in Australia, including income deemed to be derived in Australia, in particular capital gains on taxable Australian real estate.

Note: An Australian resident enterprise is a company incorporated in Australia, or an enterprise that is not incorporated in Australia but carries on business activities in Australia and whose main management is located in Australia, or an enterprise whose shareholders with controlling voting rights are Australian residents (resident enterprises or resident individuals). In addition to non-resident businesses.

1. Resident enterprises

(1) Taxable income

Generally speaking, the taxable income of the enterprise is the total amount of income-non-taxable income-tax-exempt income-the amount of each deduction-the loss of the previous year that is allowed to be covered.

① Total income

Taxable income consists primarily of general income (e. g. income from business activities, interest or royalties) and statutory income (e. g. net capital gains).

1) Dividend income

In general, Australian resident businesses are subject to corporate income tax on dividends they receive from other resident or non-resident businesses. Australian tax law distinguishes between taxable dividends and unpaid dividends for dividends received by shareholders.

Taxed dividends are the after-tax corporate income tax profits paid to shareholders by a resident enterprise. Unpaid tax dividends are those profits distributed to shareholders by a resident enterprise that are not subject to corporate income tax under certain circumstances, such as against previous years' losses, when the dividends received by shareholders are unpaid tax dividends.

2) Capital gains

Australian resident businesses are generally subject to corporate income tax on their worldwide capital gains. Companies are required to make a special disclosure on capital gains in their corporate income tax returns.

The capital gains component of the Australian corporate income tax applies to capital gains arising from assets acquired on or after 20 September 1985, based on the following formula: capital gains = proceeds from the disposal of the asset-the cost basis of the asset.

② Non-taxable and tax-exempt income

When the following conditions are met, the income obtained shall not be included in the taxable income:

1) Enterprises meet certain conditions and constitute tax-exempt taxpayers. For example, the Australian government stipulates that from July 1, 2016, if investors invest in a qualified start-up company (Early Stage Innovation Company, referred to as "ESIC"), they can enjoy non-refundable and carryable tax deductions.

2) The income obtained by enterprises meets specific tax preferential conditions and is tax-free income. For example, since July 1, 2018, Australia has implemented a new R & D tax preferential policy. For eligible entity companies engaged in research and development activities, if their total annual income is less than A $20 million, they can enjoy refundable tax credits. A non-refundable tax credit is available for companies with a total annual income of more than $20 million.

3) The income earned by an enterprise is itself non-taxable income, for example, the enterprise acquires non-portfolio dividends that are foreign. In addition, most of the government-related subsidies to stimulate the economy related to the new crown epidemic are non-taxable income.

③ Deduction amount

The pre-tax deduction amount in the income tax payable by the resident enterprise mainly includes the expenses incurred by the enterprise in the general business activities, interest expenses, loan-related expenses (amortized within 5 years or the term of the loan), eligible bad debt expenses, repair expenses, depreciation/amortization expenses, royalties, etc. An enterprise's depreciable/amortisable assets must be depreciated/amortised over the life of the asset and can be reasonably expected to be depreciated/amortised over the life of the asset, and the following are amortisable intangible assets:

1) Certain mining rights, quarrying rights and corresponding exploration rights and information property rights;

2) intellectual property rights;

3) internal software;

4) The absolute right to use the telecommunications licensing system;

5) based on a spectrum license under the Radio Communications Act;

6) Data broadcasting license;

7) Access to telecommunications sites.

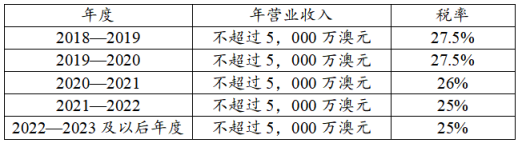

(2) Tax rate

The corporate income tax rate is unified at 30%. However, depending on the amount of annual business income of the enterprise, the tax rate is reduced, as shown in the following table:[1]

(3) Tax payable

① Calculation method

The amount of income tax payable by a resident enterprise is equal to the amount of taxable income multiplied by the applicable tax rate, and the basic calculation formula is: taxable amount = taxable income x applicable tax rate-tax deduction-tax credit

② Cases

During the fiscal year 2022-2023, the company's main business income was A $5 million, net profit was A $500000, and taxable income was A $600000. Since the company's annual operating income does not exceed A $50 million, the applicable corporate income tax rate is 25%. Enterprise income tax: 600000 × 25%= 150,000

2. Non-resident enterprises

(1) Criteria for determining the source of income

Australian common law is taxed on income whose source of income is Australia. Generally speaking, there are two common criteria for determining whether the source of income is Australia, one of which is likely to be considered as income derived from Australia: first, the income earned by the enterprise is the income of the enterprise's operations in Australia; Second, the income earned by the enterprise is paid by Australian residents or derived from assets located in Australia.

(2) Taxable income

Business income earned by a non-resident enterprise through a permanent establishment in Australia (where a tax treaty applies) is subject to tax and the general rules of resident income tax apply (see below).

Dividends paid by non-resident enterprises to their foreign shareholders on profits derived from Australia are subject to withholding income tax in Australia. If there is a tax treaty, the provisions of the treaty apply.

Non-resident corporate taxable income includes net capital gains derived from "Australian taxable property. Australian taxable property includes Australian real estate, non-portfolio indirect interests and used assets in Australian real estate, and assets used by Australian permanent establishments to conduct business.

Other income derived from Australian sources is generally subject to tax in Australia, with reference to the general rules for resident enterprises.

(3) Tax rate

In general, the same general income tax rate applicable to resident businesses applies to non-resident businesses, I .e., the 30 per cent rate. Capital gains from the sale of Australian taxable property by a non-resident Australian business are also taxed at a rate of 30% unless:

The sale of shares in Australian companies with a shareholding of not more than 10%;

② The proportion of Australian property (e. g. land, real estate) directly or briefly owned by the Australian company equity sold does not exceed 50%.

Non-resident enterprises that meet one of the above two conditions are exempt from the tax obligation on the capital gains portion.

(4) Withholding income tax

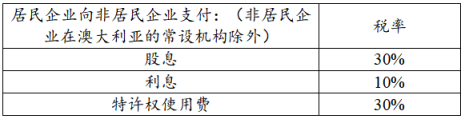

Unlike resident businesses, Australian non-resident businesses are subject to withholding income tax on income derived from Australia, as detailed in the table below:[2]

If there is a bilateral tax treaty between the country in which the non-resident enterprise is located and Australia, the non-resident enterprise may enjoy a lower withholding income tax rate for the above sources of income.

(5) Tax payable

See the relevant content of resident enterprises.

3. Enterprise income tax declaration system

(1) Declaration requirements

The tax year for Australian corporate income tax is usually from July 1 of each year to June 30 of the following year, but companies can apply to the Australian Taxation Office to use other accounting periods as the tax year. For example, a subsidiary or branch of an overseas company in Australia can apply to adopt the same accounting year as the overseas headquarters.

(2) Tax payment

① Prepaid tax

Typically, corporate taxpayers are required to pay their taxes in advance within 21 days of the end of each quarter. The withholding tax is determined on the basis of the previous year's tax amount. The last tax payment for a tax year shall be made by the first day of the sixth month following the end of the tax year.

② Remittance and settlement

The amount of tax paid in the final settlement is the annual tax payable of the enterprise's self-assessment-the four quarterly withholding tax paid by the enterprise.

The enterprise shall settle and pay the enterprise income tax before the 15th day of the seventh month after the end of the tax year (for example, if the deadline of the company's tax year is June 30 of the current year, the annual tax return shall be submitted before January 15 of the following year).

(II) personal income tax

Similar to corporate income tax, Australian personal income tax is divided into resident taxpayers and non-resident taxpayers. Australian resident taxpayers are subject to personal income tax on their worldwide taxable income (including net capital gains). Non-resident taxpayers are only required to pay personal income tax on their taxable income derived from Australia and on taxable income deemed to be derived from Australia (e. g. capital gains from taxable assets in Australia).

Note: Australian resident taxpayers generally refer to individuals who have a fixed residence in Australia (except for those whose permanent residence is outside Australia) or who stay in Australia for more than 183 days in a tax year (except for those whose habitual residence is outside Australia and who have no plans to settle in Australia). In addition to non-resident taxpayers.

1. Resident taxpayers

(1) Taxable income

Taxable income of resident taxpayers-Total taxable income earned by individuals-pre-tax deduction expenses.

① Taxable income

Taxable income consists primarily of general income (e. g. income from business activities, wages, interest or royalties) and statutory income (e. g. net capital gains). Mainly includes the following aspects:

1) Salary

Individuals should be included in taxable income when they receive wages and salaries.

2) Welfare in kind

When an employer provides non-cash benefits (e. g., cars, low-interest loans, paid vacations, free dormitories, etc.) to employees or employee affiliates, a fringe benefit tax is generated, but the taxpayer of the fringe benefit tax is the employer, not the employee.

3) Retirement income

Residents' pension income is included in taxable income, but individuals aged 60 and over who receive pensions paid from the Australian Government Chartered Retirement Fund (including pensions paid before July 1, 2007 and lump-sum pensions) may be classified as non-taxable income.

In addition, depending on the age of the recipient and the type of payment received, individuals under the age of 60 are entitled to tax incentives for pensions paid from Australian Government-chartered pension funds. Special provisions apply to pension income from non-Australian Government Chartered Retirement Funds and Offshore Retirement Funds.

4) Director fees

Directors acquired by individuals are not generally taxed on employment income.

5) Income from business activities and professional services

Personal income is generally recognized as taxable income on the basis of the realization of receipts and payments, but the accrual system applies to the business activities of individuals engaged in business activities, and their tax treatment is similar to the income of the company's business activities.

Income from professional services is also taxed on the basis of income from business activities, but income from professional services obtained by literary writers, screenwriters, musicians, artists, inventors, performers and salesmen may be divided equally for more than 4 years and the corresponding taxable income calculated from the tax year in which they obtained income from professional services exceeding A $2,500.

② Pre-tax deduction

Deductions that can be charged on a pre-tax basis are expenses incurred by an individual in the process of obtaining taxable income. Mainly includes the following expenses paid by individuals:

1) Expenses directly related to employment (e. g. transportation between different duty stations);

2) Work-related expenses (e. g. uniform fees required for work wear);

3) Interest on loans related to real estate investment;

4) Allowable deductible premiums paid by freelancers (in addition to premiums for life insurance);

5) Donation expenses paid to groups approved in Australia;

6) Tax consulting fees, etc.

However, expenses of a private nature (e. g. commuting expenses), expenses related to tax-free income (or non-taxable income), expenses related to government subsidies, social entertainment, fines, expenses related to capital gains, bribes, medical expenses, etc., are not deductible before tax.

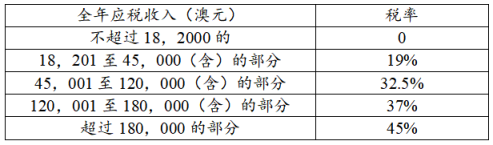

(2) Tax rate

Unlike China's comprehensive and classified personal income tax system, Australia's resident taxpayers have a comprehensive personal income tax system, and the following tax rate table applies when all types of income are combined for fiscal year 2023-2024:[3]

2. Non-resident taxpayers

(1) Expropriation scope

① Overview

The method of tax collection for non-resident individuals depends on whether the non-resident individual applies the tax treaty. Taxable income earned by non-resident individuals is taxed in accordance with the relevant provisions of the tax treaty, subject to the application of the relevant tax treaty. Australian taxpayers may be required to withhold tax in certain circumstances (e. g. recreational or sporting activities, building installations, repair activities, etc.). Where the relevant tax treaty cannot be applied, income derived or deemed to be derived from Australia by non-resident individuals is taxed in accordance with the relevant domestic provisions of Australia.

② Income from employment

Non-resident individuals pay personal income tax on income derived from their employment in Australia. For "employment income", see the relevant content of resident taxpayers above.

In addition, non-resident individuals participating in the Seasonal Labor Mobility Program are subject to withholding income tax at a rate of 15%. This provision applies to income such as wages, salaries, commissions, bonuses and subsidies paid to non-resident individuals under the above-mentioned "plan.

③ Income from business activities and professional services

Non-resident individuals are subject to personal income tax on their income from business activities and professional services derived from Australia. For "income from business activities and professional services", refer to the relevant content of resident taxpayers above.

④ Dividend income

For non-resident individual shareholders, all taxable dividends remitted by Australian resident enterprises are tax-free in Australia, but not refundable. If an Australian resident enterprise receives an unpaid dividend, the dividend withholding income tax is payable before the above dividend is received, and the tax rate is generally 30% by default. In the case of PRC tax resident shareholders, the tax rate on dividend withholding tax is 15% under the China-Australia Tax Agreement.

However, it should be noted that as there is no tax treaty between Australia and many low-tax countries and territories, unpaid dividends remitted to these countries and territories are subject to tax in Australia at the default 30% tax rate.

⑤ Capital gains

Non-resident individuals are subject to tax in Australia only in respect of their capital gains on taxable property in Australia. Overseas tax residents who have an indirect interest in Australian real estate will be subject to a "significant asset test" (Principal Asset Test) to ensure that overseas tax residents pay full asset value added tax in accordance with the law.

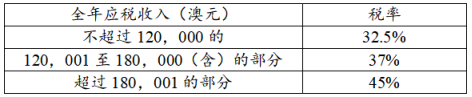

(2) Tax rate

The applicable individual income tax rates for non-resident taxpayers for fiscal year 2023-2024 are shown in the following table:[4]

(3) Pre-tax deduction

See above for resident taxpayers.

(4) Tax benefits

Non-resident taxpayers pay income tax only on income derived in Australia and are generally not entitled to tax credits in Australia. However, if a non-resident individual becomes the spouse of an Australian resident, it is likely to be regarded as an Australian tax resident after comprehensive judgment by the Australian Taxation Office in combination with the actual situation (for example, a non-resident individual becomes the spouse of an Australian resident and lives in Australia with his or her spouse, and is often approved to hold an Australian temporary spouse visa, in which case it is likely to be regarded as an Australian tax resident by the tax authorities), enjoy the same tax benefits as Australian residents.

3. Personal income tax declaration system

(1) Declaration requirements

Taxpayers with annual taxable income of more than A $18,200 should file an individual income tax return, but in some special circumstances, taxpayers with annual taxable income of less than A $18,200 should also file an individual income tax return, such as where the tax has already been withheld at the time of payment to the taxpayer. The filing methods include electronic filing, telephone filing and the use of simplified filing forms. All non-resident taxpayers are required to file an individual income tax return on their Australian income of origin.

In general, for tax years ending June 30, taxpayers should submit their tax returns by October 31 of that year. If the declaration is made by the tax agent, an extension may be granted. After the taxpayer submits the return, the Australian Taxation Office will make the final tax assessment within a short time.

(2) Tax payment

Under the pay-as-you-go system, the taxpayer's tax payable is basically paid through withholding. Taxpayers who acquire business income or investment income shall pay tax in advance on a quarterly basis in accordance with the proportion set by the Australian Taxation Office. In general, the quarterly advance payment period is within 21 days after the end of each quarter. The annual final settlement of taxes for that year shall be completed before the 15th of the 7th month after the end of the tax year (for example, if the deadline for the tax year is June 30, the final settlement shall be completed before January 15 of the following year). The final settlement tax is the balance of the self-assessed annual tax payable minus the four quarterly withholding tax. If the amount of withholding tax exceeds the amount of tax payable by the taxpayer's self-assessment, the excess will be refunded.

(III) Goods and Services Tax (Goods and Services Tax)

1. Scope of collection

A GST taxpayer who has registered or is subject to GST registration in Australia, sells taxable goods or provides taxable services in the country, or imports goods and services. Taxpayers are liable to GST on taxable goods and services sold or imported within Australia. Businesses with an annual turnover of more than A $75,000 (A $150,000 for non-profit organizations) are required to register for GST. All taxi operators must be registered, regardless of their annual turnover.

2. Tax rate

The Australian GST rate is 10%, except for the following goods or services to which a zero rate applies:[5]

(1) certain types of food sold or provided by the taxpayer;

(2) medical services;

(3) educational services;

(4) Child care services;

(5) Export of goods and services;

(6) charitable activities;

(7) Some transportation services involving non-resident taxpayers;

(8) First-hand sales of precious metals after refining, etc.

3. Tax payment

Taxpayers with GST taxable income of more than A $20 million should submit a monthly electronic tax return and calculate the tax payable. The reporting period shall be within 21 days after the end of the current month. If GST taxable income is less than A $20 million and the taxpayer is not required to file monthly tax returns by the Australian Taxation Office, quarterly returns may be made. The reporting period is 28 days after the end of the quarter. GST taxable income is less than A $75,000 (A $150000 for non-profit organizations) and the taxpayer is voluntarily registered as a GST taxpayer, with the option of filing on an annual basis. The filing period is usually before the end of the income tax filing.

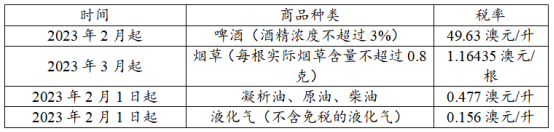

(IV) consumption tax

The Australian Federal Government imposes excise taxes on special commodities such as alcohol products (except wine), fuel and petroleum products, and tobacco produced and manufactured in Australia. Different consumption tax rates apply to different goods. The following are partial rates of consumption tax:[6]

(V) property tax

The state governments have their own property tax regulations to stipulate the scope of their collection, the applicable progressive tax rate (between 0.15 and 3.7 per cent), the tax exemption threshold, the exemption items, etc. The items that can be exempted from property tax are generally the main residential land or primary production land of the property owner.

(VI) stamp duty

Stamp duty is an important tax levied by the state governments, and each state government formulates its own stamp duty regulations to stipulate the scope of its collection, applicable tax rates, exemption items, etc. Generally speaking, stamp duty is mainly applied to property transfer transactions (e. g. real estate, mineral rights, certain types of private property, goodwill, intellectual property, company shares, trust shares, insurance policies, vehicles, etc.), with the transfer price as the basis for taxation, and the tax rate is generally around 5% to 6%.

Some states impose stamp duty surcharges on non-resident buyers, which involve direct or indirect acquisition of residential land. Definitions of non-resident purchasers, definitions of residential land, and additional tax rates are left to the individual states.

3. Australian Tax Collection and Management System

(I) tax collection

Australia's tax collection and management power is mainly concentrated in the Federal Inland Revenue Service. The Federal Inland Revenue Service is composed of 5 departments and has set up 24 tax offices across the country, all in relatively densely populated large cities, such as Sydney and Melbourne. The Australian State Taxation Office has a general office in each state. According to the local division, the cantons have local tax agencies under their local finance bureaus.

The superior between the tax authorities is the Federal Tax Administration and the subordinate is the State Tax Administration. The state tax bureaus have the same status and are all horizontal agencies at the state level under the Federal Tax Administration. However, the State Tax Office is part of the State Department of Finance, which is responsible for collecting state taxes and handing them over to the state government.

The Australian Federal Taxation Office is mainly responsible for collecting corporate income tax, personal income tax, goods and services tax, consumption tax, fringe benefit tax and other federal taxes, and also manages the Australian business registration and pension system. The Australian State Tax Office is mainly responsible for collecting payroll tax, stamp duty, land tax, etc.

(II) management system

Australia has a taxpayer self-assessment system, where taxpayers can apply in their tax returns to ask the Inland Revenue Department to consider making a tax ruling on specific filing items. If the taxpayer does not submit a tax return or the tax bureau considers that the tax return does not meet the requirements, the tax authority will approve the amount of tax payable.

(III) non-performance of tax obligations penalties

1. Penalties for non-payment or underpayment of taxes

Taxpayers who inadvertently underpay taxes shall pay a fine of 25% of the underpaid taxes. Taxpayers who underpay more than A $10000 (or 1% of the income tax payable, whichever is higher) and have no reasonable reason to pay a fine of 25% of the underpaid tax; During the new crown epidemic, the Australian Taxation Bureau waived any interest and fines applicable to tax liabilities incurred on or after January 23, 2020.

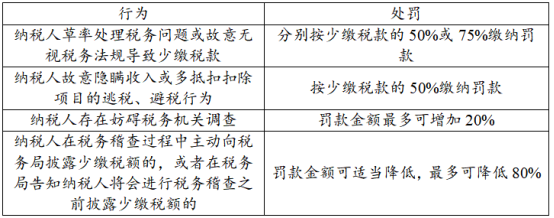

2. Penalties for evading the recovery of tax arrears [7]

3. Other penalties

(1) Late payment of tax is calculated on the basis of daily compound interest late fees (general late fees). Since July 1, 2001, the late fee interest rate is increased by 7% on the basis of the 90-day bank acceptance bill interest rate. The late fee rate will be announced on the tax bureau's website two weeks before each quarter, and the annualized rate for the general late fee in the third quarter of 2022 will be 8.0 per cent;

(2) The Inland Revenue Department has the right to reduce all or part of the fine at its discretion, but the late fee can only be reduced in very special circumstances;

(3) If the tax payable is increased after tax assessment by the Inland Revenue Department, the taxpayer shall pay the difference late fee on the basis of compound interest instead of the general late fee. The difference late fee interest rate is determined by 4 percentage points lower than the general late fee interest rate, starting from the tax assessment date. The Inland Revenue Department has the right to reduce the difference in late fees.

4. China-Australia Tax Treaty

(I) tax treaties and multilateral conventions

The Chinese Government and the Australian Government signed the Agreement between the the People's Republic of China Government and the Australian Government on the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income in 1988, which was implemented on January 1, 1991. There are 28 articles in the Sino-Australian tax agreement, the main part of which includes the scope of application of the agreement, the solution of double taxation, the negotiation procedure and the exchange of tax information, of which the solution of double taxation occupies the largest space, reflecting the core purpose and purpose of the tax agreement to eliminate double taxation.

In addition, the Chinese government and the Australian government both signed the Multilateral Convention on the Implementation of Tax Treaty-Related Measures to Prevent Base Erosion and Profit Shifting on June 7, 2017. The multilateral convention amends some of the provisions of the China-Australia Tax Agreement, which entered into force for Australia on 1 January 2019 and for China on 1 September 2022.

(II) tax incentives [8]

According to Article 10 of the China-Australia Tax Agreement, the dividend income of a Chinese investor as a beneficial owner from an Australian resident company in which the investment is made may be taxed in China. At the same time, the above-mentioned dividends may also be subject to withholding income tax in Australia in accordance with its laws, but the tax levied shall not exceed 15% of the total amount of the dividends.

According to Article 11 of the China-Australia Tax Agreement, the interest income obtained by a Chinese investor as a beneficial owner from Australia may be taxed in China and may also be taxed in Australia in accordance with its laws, but the tax levied shall not exceed 10% of the total interest. If the interest income is actually related to the permanent establishment of a Chinese resident enterprise in Australia, the interest income will be subject to corporate income tax in Australia under the operating profit clause of the agreement.

Article 13 of the China-Australia Tax Agreement provides for the right to tax on the transfer of property. If a Chinese resident transfers gains from immovable property located in Australia, the Australian Taxation Office has the right to tax the transferor. If a Chinese resident enterprise has a permanent establishment in Australia, the Australian Taxation Office has the right to tax the income arising from the transfer of movable property in the business property. The Australian Taxation Office has the right to tax the transferor if the property of the transferred Australian resident company consists primarily, directly or indirectly, of immovable property located in Australia, on the proceeds (including shares or similar interests in a partnership or trust interest) derived by a Chinese resident from the transfer of its shares in an Australian resident company. Equity transfer is an important way for Chinese residents to withdraw from investment in Australia. Therefore, Chinese residents should do a good job in planning before investment to avoid paying heavy tax costs when withdrawing in the future.

For Chinese residents who invest or engage in business activities in Australia, whether they constitute a permanent establishment in Australia in accordance with the provisions of the China-Australia Tax Agreement directly affects the tax costs of Chinese residents in Australia. Therefore, Chinese residents should make reasonable arrangements for investment activities in Australia and effectively use the provisions of the agreement to avoid being recognized as a permanent establishment.

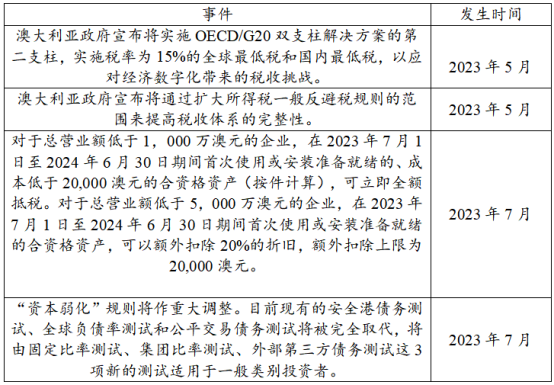

Tax reform in Australia over the past year:[9]

References:

[1] https://www.ato.gov.au/rates/company-tax/?anchor=Taxrates202223#Taxrates202223 。 Last visit: 9 October 2023.

[2] Tax Guide for Chinese Residents to Invest in Australia, pp. 18-19.

[3] https://www.ato.gov.au/Rates/Tax-rates---Australian-residents /. Last visit: 9 October 2023.

[4] Tax Guide for Chinese Residents to Invest in Australia, p. 28.

[5] https://www.ato.gov.au/Business/GST/When-to-charge-GST-(and-when-not-to)/. Last visit: October 10, 2023.

[6] https://www.ato.gov.au/Business /. Last visit: October 11, 2023.

[7] Tax Guide for Chinese Residents to Invest in Australia, p. 48.

[8] Agreement between the Government of the People's Republic of China and the Government of Australia for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income

[9] Tax Guide for Chinese Residents to Invest in Australia, p. 7.

Related recommend

Lawyer Research Center, China University of Political Science and Law

Beijing Lawyers Association