Huixiang Research

Huixiang Sydney | Investment Guide to Australia-Australian Labor Regulations (Series 6)

2023-09-28

In the last investment guide to Australia, we introduced Australia's complete intellectual property system. Investors going to Australia should follow the corresponding steps when making relevant intellectual property applications. If you encounter intellectual property disputes in the course of business operations, you should also seek professional legal services.

In addition, in the first issue of the investment guide to Australia, we mentioned that Australia is a country of immigrants, so the composition of labor in Australia is more complicated. And because the initial workers in Australia were early criminal immigrants, political prisoners and trade union leaders, Australian labor laws are more complicated than domestic laws, and investors in Australia need to pay necessary attention to Australian labor laws.

History of Australian Labor Laws and Regulations in (I)

Labor law in Australia has its origins in English common law. Initially, labor-related laws were enacted by the states, which had different wage standards and labor dispute resolution systems. When the Federal Constitution of Australia was promulgated in 1901, it was mentioned in Article 51 that the Federal Court would have jurisdiction over the conciliation and arbitration of labor disputes beyond the scope of the states. However, with the increase of trade exchanges between Australia and other countries, trade frictions are also occurring frequently, especially the different labor laws of different states are difficult to maintain good trade relations, so it is necessary to carry out unified labor legislation. The Federal Government of Australia enacted the Industrial Relations Act (Industrial Relation Act) in 1988, which was amended and renamed the Labor Relations Act (Workplace Relation Act) in 1996. In 2005, the Federal Government amended the Labor Relations Act to establish the Fair Wok Commission in Australia. In 2009, the Federal Government enacted the Fair Work Act to replace the Labor Relations Act. It makes the Fair Work Ombudsman (Fair Work Ombudsman) responsible for the implementation of the Ordinance of the Fair Work Act.

(II) Australia's Fair Work Act

The Federal Government of Australia enacted the Fair Work Act in 2009, and since then industrial relations in Australia have largely come under its jurisdiction. The Fair Work Act is a compilation of codes, which consists of two volumes. The first volume belongs to the content of substantive law, while the second volume is about the provisions on the implementation of the law. The first volume of the Act consists of three parts, the first of which is an introduction (Introduction), including general provisions; the second part is the terms and conditions of labor (Terms and Conditions of Employment), which mainly provides for general labor benchmarks, including working hours, rest and leave, notice of dismissal and severance pay, minimum wage, equal wage, transfer of enterprises, payment of wages, etc; title III, Rights and Responsibilities of Employees (Employers,Organisations etc.), includes general rules on the protection of workplace rights, freedom of association and freedom to engage in legitimate industrial action (Industrial Action), freedom from discrimination, as well as wrongful dismissal, industrial action, the enforcement power of relevant law enforcement agencies, and the suspension of employees by employers. The second volume consists of three parts, the fourth, "Compliance and Enforcement" (Compliance and Enforcement), which mainly stipulates civil remedies and jurisdiction and court powers; the fifth, "Administration" (Administration), which stipulates the functions of the "Fair Work Commission" (Fair Work Commission) and the "Office of the Fair Work Ombudsman" (Office of the Fair Work Ombudsman); and the sixth, "Miscellaneous" (Miscellaneous). The provisions of the Fair Work Act are extremely complex, coded to article 800, but the integrity and systematicness of the Code are weak, there is no content on occupational safety and health in the Code, and Title III, "Rights and duties of employees, employers, organizations, etc.", is complex.

In Australia, most employer-employee employment relationships are ultimately governed by the Fair Work Act, whether they are governed by rulings by industry bodies, collective agreements agreed between employees and employer groups, or separate employment contracts. Therefore, investors in Australia should have a detailed understanding of Australia's Fair Work Act before investing.

(III) National Employment Standards

Australia's National Employment Standards (National Employment Standards, hereinafter referred to as "NES") are set out in the Fair Work Act, and all employees have the right to require employers to provide the minimum conditions in the National Employment Standards NES set out in the Fair Work Act. [1]

The NES is primarily concerned with the following matters:

• Maximum working hours per week;

• Flexible working arrangements;

• Maternity and parental leave;

• Annual leave;

• leave of absence;

• Community service leave;

• Long service leave;

• Public holidays;

• Notice period of termination and severance payment.

It should be noted that although the working conditions listed above are subject to the NES, the specific conditions may vary by employee contract, industry, union agreement or local regulations. Therefore, both employers and employees need to understand their rights and obligations and ensure compliance with appropriate laws and union agreements.

(IV) labor contract

labor contract type]

Employees can choose between a ruling (modern ruling), a registration agreement (business agreement), or an employment contract as defined by the NES and state and federal laws.

• A ruling (modern ruling) is a legal document that outlines the wages and conditions of employment of employees covered by a particular trade or occupation.

• A registration agreement is a document between an employer and an employee regarding the conditions of employment. Agreements must be approved and registered by the Fair Work Commission. Examples of registration agreements include enterprise agreements, collective agreements, greenfield agreements, certification agreements, Australian Workplace Agreements (AWA) and Individual Transitional Employment Agreements (ITEA).

• An employment contract is an agreement between an employer and an employee on the terms and conditions of employment. The contract may be written or oral. Labor contracts may not provide for less than the minimum statutory benefits (10 minimum benefits) and rulings or enterprise agreements that may apply under the NES.

probation period]

The length of the probationary period can be determined by the employer, ranging from a few weeks to several months, usually between 3-6 months. During this period, full-time and part-time employees are entitled to accrue and receive paid leave, such as annual and sick leave. If the employee fails the probation period, the employer must notify the employee that the employee is entitled to the accumulated unused annual leave.

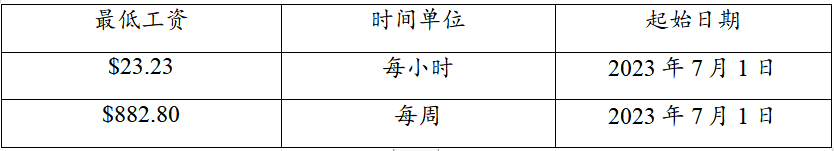

(V) minimum wage

The minimum wage standard refers to the minimum wage legally paid by the employer to the employee. The Australian minimum wage is set by the Fair Work Commission and is reviewed annually to ensure it keeps pace with inflation and other economic factors. In order to ensure that employees are paid a reasonable salary, investors are advised to check on the official website of the Fair Work Commission.

On 1 July 2023, the Fair Work Commission adjusted the minimum wage to:[2]

However, the above standards only apply to employees who are not rewarded for work or are not protected by the Enterprise Agreement. Employees are entitled to higher wages if they are subject to other incentives or protected by corporate agreements. In addition, the minimum wage in Australia is a legal requirement, and employers who fail to pay the minimum wage to their employees may face penalties and fines.

(VI) working hours

The maximum weekly working hours of an employee as defined in the NES are:[3]

• Full-time work with a maximum of 38 hours per week;

-Part-time work, unless otherwise specified, should not exceed 38 hours per week.

Overtime is considered when working hours exceed the following criteria:

• Normal working hours;

• Normal working hours (e. g., 9 a.m. to 5 p.m.);

• Other working hours as mutually agreed.

The employer needs to pay 1.5 times overtime for the first three hours of overtime, and 2 times overtime for each hour after that. Overtime on Saturdays, Sundays and public holidays is usually paid twice or 2.5 times overtime.

Although the maximum weekly working hours of employees are fixed, other rest rights of employees, such as lunch breaks and breaks between shifts, will vary by industry and occupation.

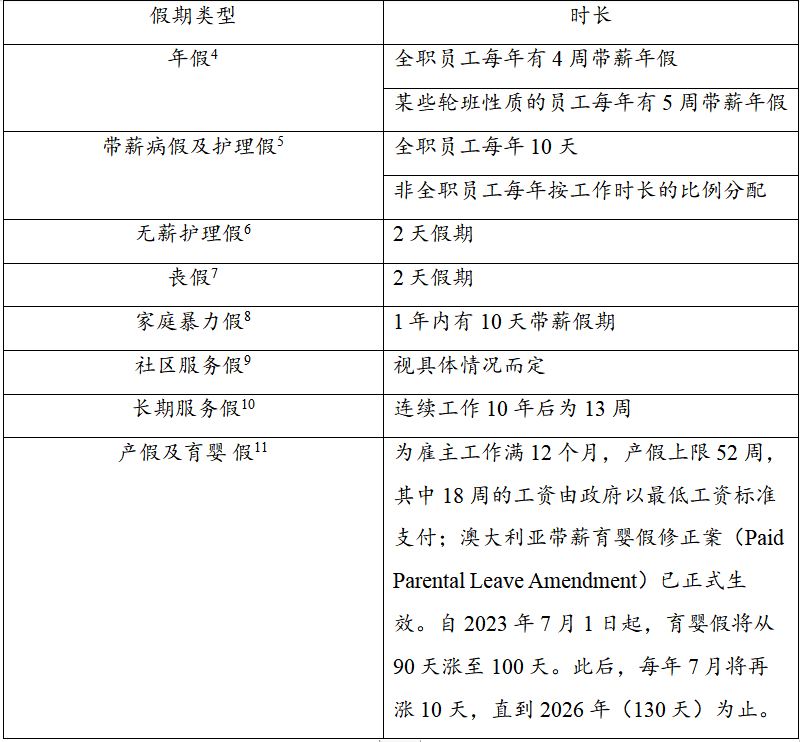

(VII) leave policy

Australia's Fair Work Act provides for the duration of leave for employees, and employers should ensure that employees fully enjoy the leave. The different types of leave and their duration are as follows:

(VIII) old-age security system

Australia's old-age security system is relatively perfect, the old-age security system needs to be paid attention to by investors in Australia for pensions and pensions.

pension]

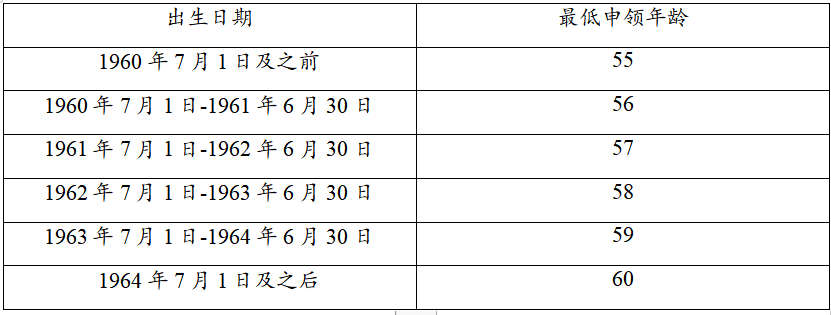

Superannuation is a mandatory savings system designed to provide retirement income to employees in Australia. Under the old-age security system, employers are required to contribute a portion of their employees' income to the pension fund. As of 1 July 2022, the employer's minimum contribution rate is 10.5 per cent of the employee's regular time earnings. By 2025, this rate will increase to 12%. Employees can choose their own pension fund institution or use the employer's default fund. However, employees can only withdraw their use if they meet the minimum age for claiming a pension, and the minimum age for claiming a pension varies depending on the time of birth:[12]

pension]

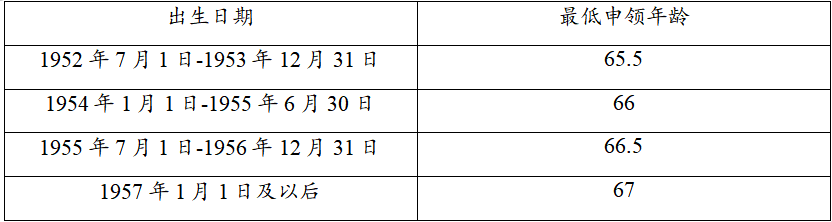

In addition to pensions, Australia's pension system also includes a basic pension. The basic pension is a retirement subsidy issued by the government to ensure the basic living needs of individuals after retirement. The government will determine the amount of pension according to personal assets and income. At the same time, employees also need to reach the corresponding age when claiming the basic pension. The specific minimum age of claim is as follows:

Termination of (IX) employment contract

When an employer and an employee terminate their contract, they should refer to the terms of employment and the business agreement for information on the notice period and severance pay.

Resignation Notice Period]

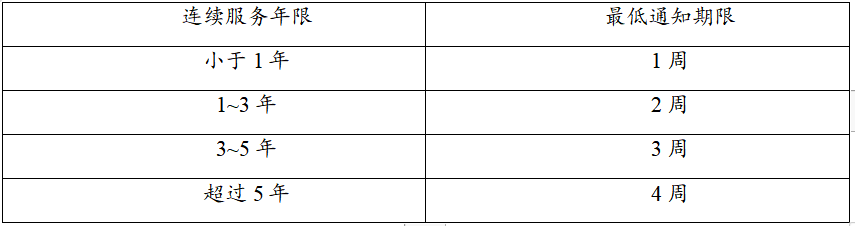

Depending on the length of service of the employee, the employer must give the following minimum statutory required notice period when dismissing the employee:

In addition, if the employee is over 45 years of age and has worked for the employer for at least 12 months, he/she must be given an additional one-week notice period.

severance pay]

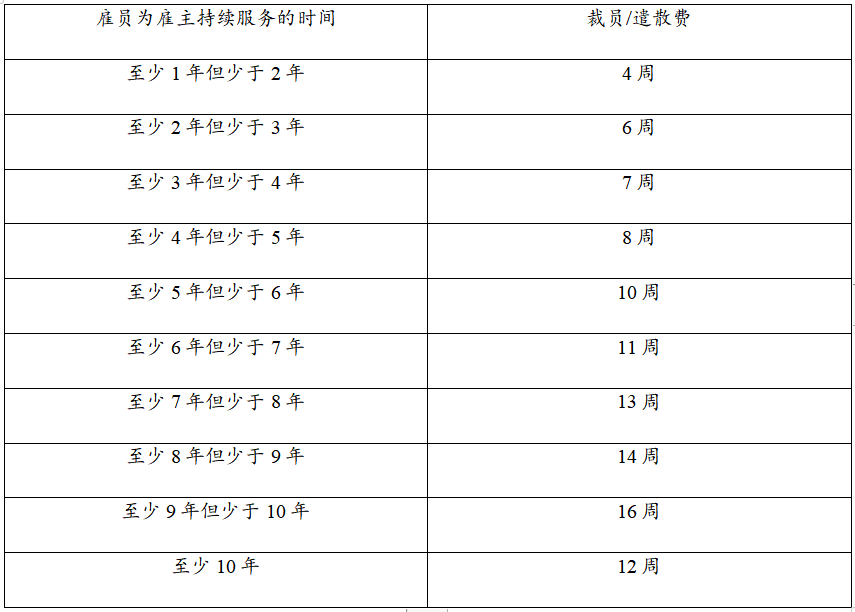

The severance payment to which an employee is entitled depends on the employee's length of continuous service with the employer, but does not include unpaid leave, as detailed in the table below.

In addition, in some cases, no severance payment is required. For example, if the employer is a small business, the employee has less than 12 months of continuous service, or the length of time the employee has been employed, assigned tasks or projects, specific seasons, etc. After 10 years of continuous service, the amount of severance pay is reduced because the Australian Government believes that at this point the employee is also entitled to paid long service leave.

Relevant regulations for (X) foreign employees

According to the regulations of the Australian Immigration Administration, when Australian companies or overseas companies hire overseas workers in Australia, the company must provide guarantees for foreign workers and apply for temporary business visas for them.

There are several types of temporary business visas:

(1) Temporary technology shortage visa (TSS,482 visa), the validity period is divided into 2 years (short-term) and 4 years (medium and long-term);

(2) Temporary work visa (400 visa, valid for 6 months);

(3) Temporary work visa for graduates (485 visa). International students who have studied in Australia for more than two academic years can apply for a 485 visa as a transition to a permanent residence visa as long as they meet the conditions.

[1] Article 61 of the Fair Work Act.

[2]https://www.fairwork.gov.au/pay-and-wages/minimum-wages。

[3] Article 62 of the Fair Work Act.

[4] Section 87 of the Fair Work Act.

[5] Section 97 of the Fair Work Act.

[6] Section 103 of the Fair Work Act.

[7] Section 104 of the Fair Work Act.

[8] Section 106A of the Fair Work Act.

[9] Section 108 of the Fair Work Act.

[10] Section 103 of the Fair Work Act.

[11] Article 70 of the Fair Work Act.

[12]https://www.fairwork.gov.au/pay-and-wages/tax-and-superannuation。

Related recommend

Lawyer Research Center, China University of Political Science and Law

Beijing Lawyers Association